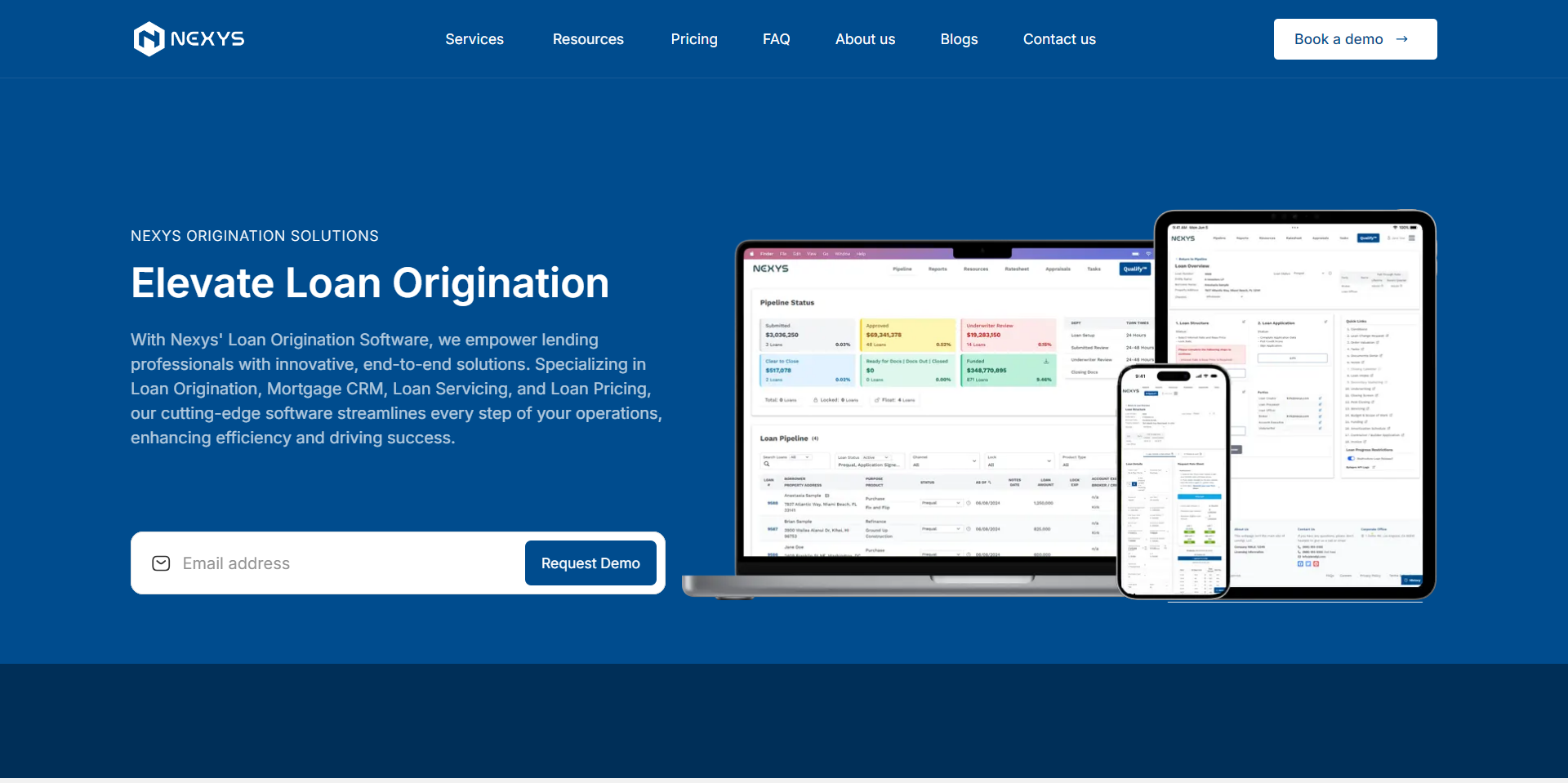

Kirk Ayzenberg’s Nexys: Transforming Loan Origination with Innovative Tech

Kirk Ayzenberg’s Nexys is changing how loans are handled, using advanced technology to make the process faster and more efficient. By focusing on innovative technology, Nexys aims to simplify the way loans are originated, benefiting both lenders and borrowers. This cutting-edge approach not only streamlines the loan process but also reduces errors and increases transparency for all parties involved.

Kirk Ayzenberg leads this shift with a clear vision, emphasizing the use of smart solutions to solve common problems in loan origination. Through the integration of new tools and systems, Nexys reduces the time it takes to process loans, enhancing the overall experience for users.

As the demand for more efficient financial solutions grows, Nexys stands out as a leader in the industry. Their commitment to revolutionizing loan origination reflects a broader trend towards utilizing technology to improve everyday financial tasks.

Background on Loan Origination

Loan origination is the process that begins when a borrower applies for a loan and ends when the funds are disbursed or the application is denied. It involves several steps and players, including applicants, lenders, and financial institutions.

Evolution of the Lending Process

Over the years, the lending process has transformed significantly. Initially, it was manual and paper-based, with applicants visiting local banks or lenders to apply for loans. Each application went through a slow verification process, often taking days or weeks.

With technological advancements, the process became digitized. Online applications became possible, allowing borrowers to submit requests from home. The integration of systems enabled faster verification of information such as credit scores and income.

Today, automation and algorithms enhance decision-making. They reduce human error, speeding up approvals significantly. While traditional banks still play a key role, fintech companies are rapidly gaining a foothold, offering alternative lending options and streamlining processes even further. This shift emphasizes the role of technology in transforming the financial services sector.

The Role of Financial Institutions in Loan Origination

Financial institutions are central to the loan origination process. They include banks, credit unions, and online lenders. These institutions assess the risk of lending to each applicant. They verify identities, check credit histories, and evaluate financial statuses before deciding.

A vital part of their role is ensuring regulatory compliance across all steps. They must adhere to laws and guidelines designed to protect both lenders and borrowers. This is crucial for maintaining trust and transparency.

Financial institutions also provide resources and support during the loan process. They assist with documentation, offer counseling, and once the loan is approved, manage the funds distribution. Their contributions to the financial sector remain significant, combining expertise and resources to facilitate proper loan origination practices.

The Impact of Technology on Loan Origination

Technology is transforming how loans are originated, making the process faster and more efficient. Digital tools and software solutions are playing a crucial role in this change.

Digital Transformation in the Lending Industry

The lending industry is seeing big changes with the help of digital transformation. This includes digitizing paper processes, which makes them quicker and easier to manage. Lenders use digital lending platforms to connect with borrowers over the internet. These platforms help reduce the time needed to approve loans.

Automating tasks is another part of this transformation. It speeds up credit checks and data processing, allowing lenders to make decisions faster. Borrowers often benefit from a more user-friendly experience. With online tools, they can upload documents and track their application status easily.

Digital transformation in lending leads to better efficiency and customer satisfaction. By using technology, lenders can also increase accuracy and reduce human errors. This benefits both lenders and borrowers, creating a smoother lending process.

Loan Origination Software and Its Functions

Loan origination software is essential for modern lending. These platforms manage the entire loan process from application to approval. They help streamline operations so that lenders can handle more applications with less effort.

Key features include automation, which reduces manual tasks like data entry. It also offers data analysis tools that help lenders assess borrower risk. This software often integrates with other systems, providing a seamless flow of information.

Security features ensure that borrower information remains confidential. This is critical as data protection regulations become stricter. By using loan origination software, lenders can enhance operational efficiency and improve compliance with legal requirements. This software is a crucial element in today’s fast-paced lending environment.

Enhancing Customer Experience and Satisfaction

Kirk Ayzenberg’s Nexys uses advanced technology to make borrowing smoother and more enjoyable. By focusing on ease of use and simplifying application processes, customers find greater satisfaction and engagement.

Improving the Borrower Experience through Technology

Nexys leverages modern technology to transform how borrowers interact with loan systems. The platform offers a smooth digital experience that makes loan applications easy and efficient. Borrowers can expect quick responses, reducing waiting times and stress. This speed in processing results in improved customer satisfaction.

Additionally, Nexys uses secure systems to protect sensitive data, which enhances trust. This focus on security reassures users, making their experience not only smoother but safer. Ultimately, Nexys ensures that the overall process is less of a hassle for borrowers, giving them peace of mind.

User-Friendly Interfaces and Streamlined Application Submission

A key feature of Nexys is its user interface, which prioritizes clarity and ease of use. It is designed for all users, regardless of tech skills, making it accessible for everyone. This approach means less confusion and a more direct path for borrowers.

The application submission process is simplified with clear steps and guidance. With intuitive navigation, users can easily complete forms, upload necessary documents, and track their application’s progress effortlessly. This straightforward process reduces friction and enhances the enhanced customer experience, leading to higher satisfaction rates. By making each step of the application user-friendly, Nexys helps more people feel confident and in control.

Achieving Efficiency and Operational Excellence

Kirk Ayzenberg’s Nexys is transforming how loans are processed by harnessing modern technology. Key elements include automation that trims costs and improves speed and accuracy for faster loan approvals.

Automation and Reduced Operational Costs

Automation plays a crucial role in Nexys’s success. By automating routine tasks, the system minimizes the potential for human error. This not only boosts accuracy but also ensures reliable data processing.

Cost savings are significant as well. Automation reduces the need for extensive manual labor, leading to lower operational expenses. For businesses, this means allocating resources more efficiently, focusing on growth rather than administrative tasks.

Key Advantages:

- Reduced Human Error: Automation ensures tasks are accurately completed.

- Lower Expenses: Minimized manual labor costs.

- Resource Allocation: Resources can be redirected to high-impact areas.

Improved Accuracy and Faster Processing Times

Nexys leverages technology to enhance processing speed. Automated systems quickly analyze data, allowing for quicker decisions on loan applications. This speed is vital in a competitive market where time matters.

Accuracy is also a standout feature. By relying on precise calculations, Nexys reduces discrepancies and maintains data integrity. Customers benefit from quick, dependable service that aligns with their needs.

Highlights of Improved Accuracy and Speed:

- Quick Analysis: Technology speeds up data review.

- Precise Calculations: Reduces errors in processing.

- Customer Satisfaction: Faster loan approval times enhance client experience.

Compliance, Security, and Risk Management

Kirk Ayzenberg’s Nexys takes compliance, security, and risk management seriously in the loan origination process. The platform uses advanced tools to ensure compliance with regulations, protect data privacy, and detect fraud efficiently.

Maintaining Regulatory Compliance and Data Privacy

Nexys prioritizes regulatory compliance by adhering to relevant rules and standards. The platform stays updated with regulatory changes to avoid legal issues. Regular audits and reports help verify that Nexys meets all requirements.

To protect data privacy, Nexys uses encryption and secure storage methods. This ensures that customer information remains safe from unauthorized access. Privacy policies are prominently communicated to users, giving them confidence in how their data is managed.

Advanced Risk Assessment and Fraud Detection

Risk management is a crucial aspect of Nexys. Using data analytics, the platform identifies potential risks in loan applications. This reduces the likelihood of defaults and increases overall reliability.

Fraud detection is a key feature in Nexys’s system. By analyzing patterns and inconsistencies, it identifies suspicious activities. Automated alerts are set up to notify relevant teams, allowing quick response to any fraud attempts. This proactive approach safeguards both the company and its customers.

Innovations in Loan Decisioning

Nexys is changing the way loans are approved by using advanced technology. It brings faster and smarter solutions to loan origination, improving both credit decisions and pricing strategies.

Integrating Machine Learning and Artificial Intelligence

Nexys uses machine learning and artificial intelligence to boost the speed and accuracy of loan approvals. These technologies help analyze financial data quickly, allowing underwriting to become more efficient. By understanding patterns in large datasets, AI systems can anticipate the likelihood of default more accurately than traditional methods.

This means less risk for lenders and more access to loans for borrowers. Through continuous learning, these systems improve and reduce errors over time, ensuring more reliable outcomes.

Predictive Analytics for Credit Decisions and Pricing

Predictive analytics plays a crucial role in making informed credit decisions. It involves using data models to forecast a borrower’s creditworthiness, leading to more personalized and competitive loan pricing. By evaluating a wide range of credit factors, predictive analytics provides a more comprehensive view of a borrower’s capability.

This approach not only aids in setting loan pricing that reflects individual risk but also enhances the decision-making process by identifying potential risks early. As a result, borrowers receive loan offers that better match their financial profiles, and lenders optimize their returns.

Integrating Advanced Technologies and Analytics

Kirk Ayzenberg’s Nexys is reshaping the loan origination process by using advanced technologies and analytics. The goal is to streamline workflows and make smarter, data-driven decisions.

Data-Driven Decision Making and Advanced Algorithms

Nexys employs advanced algorithms to enhance decision-making. These algorithms analyze vast amounts of data quickly and accurately. They enable lenders to assess risk more precisely, ensuring loans are approved with minimal risk.

By using data-driven decision-making, Nexys not only boosts efficiency but also increases accuracy. This means fewer errors and a better experience for both lenders and borrowers.

Algorithms also adapt over time. As more data is processed, they become more effective. This adaptability is critical, ensuring that Nexys remains at the forefront of loan origination technology.

Leveraging Big Data and Analytics for Lending

Big data plays a crucial role in Nexys’s approach. They process large datasets to extract meaningful insights that support lending decisions. With analytics, patterns and trends become visible, guiding lenders in their choices.

Analytics help identify potential risks and opportunities. By examining historical data, lenders can forecast future scenarios more accurately. This foresight helps prevent issues before they arise, leading to safer lending practices.

Additionally, the use of big data in lending fosters personalized solutions. Borrower profiles become clearer, allowing for tailored lending options that match individual needs and circumstances. This personalization enhances user satisfaction and trust in the lending process.

Loan Origination in the Future

The future of loan origination will be shaped by advanced technology and a focus on adapting to shifting market demands. Innovation and collaboration among industry players will drive changes in scalability and adaptability.

Scalability and Adaptability in an Evolving Market

In the coming years, loan origination will rely heavily on new technologies to meet growing demand. Platforms capable of processing large volumes with speed and efficiency will become the norm. Companies will need systems that can scale quickly to handle fluctuations in market trends.

Adaptability will be equally crucial as loan providers face rapidly changing consumer expectations and regulatory environments. Firms will need to make quick adjustments to maintain compliance and offer competitive service.

Leveraging AI and data analytics can allow companies to predict changes in borrower behavior, offering tailored solutions. Such technologies will enhance user experience and operational efficiency, providing a significant competitive edge.

The Road Ahead: Continuous Innovation and Collaboration

Innovative technology will continue to transform loan origination. Open banking and fintech partnerships will redefine how loans are processed. Companies will benefit from collaborating to create integrated solutions that enhance user experience and streamline operations.

By working together with diverse stakeholders, from tech firms to regulatory bodies, lenders can explore new opportunities for service delivery. This collaboration will be key in navigating the complex landscape of future lending.

Staying ahead will require a proactive approach, investing in cutting-edge solutions and predicting future market shifts. Only those willing to innovate and adapt will thrive in the changing world of loan origination.