Elevate Your Portfolio with Kirk Ayzenberg’s Finresi: Pioneering Investment Tech

In the fast-paced world of finance, innovation is key. Investors are constantly looking for tools that offer efficiency and insight. Kirk Ayzenberg’s Finresi stands out as a leading solution in investment technology. This platform combines cutting-edge algorithms with user-friendly interfaces to create a smarter way to manage portfolios.

Finresi empowers investors by providing precise data and analytics, enabling them to make informed decisions. It integrates seamlessly with various financial markets, offering real-time updates and tailored advice. The balance between advanced technology and accessible design makes it suitable for both new and seasoned investors.

Kirk Ayzenberg’s vision for Finresi is clear: to create a tool that simplifies complex investment strategies. By focusing on clarity and ease of use, it redefines how individuals engage with their portfolios. With continued advancements, Finresi is set to shape the future of investment technology.

Overview of Finresi

Finresi, developed by Kirk Ayzenberg, represents a new wave in investment technology. It combines advanced tools and a clear vision aiming to redefine how investors manage their portfolios.

Pioneering Investment Technologies

Finresi incorporates cutting-edge technologies to elevate investment portfolios. Utilizing artificial intelligence and data analytics, it offers real-time insights and predictive models. These tools help users make informed decisions by analyzing market trends swiftly.

Another key feature is its user-friendly interface. Investors can easily customize data views, making it accessible for both beginners and seasoned professionals. The adaptability of Finresi attracts diverse investors looking to optimize their strategies.

Partnerships with tech innovators ensure Finresi remains at the forefront of investment solutions. Continuous updates keep it competitive in a fast-paced financial world.

Kirk Ayzenberg’s Vision for Finresi

Kirk Ayzenberg, the CEO, envisions Finresi as a transformative force in financial technology. His initiative focuses on transparent and efficient portfolio management. His leadership emphasizes both innovation and user trust, creating a foundation for the platform’s growth.

A commitment to sustainability is embedded in Finresi’s core values. Ayzenberg aims to align financial success with responsible investing, encouraging socially conscious decisions.

Through collaboration with experts and ongoing technological advancements, he seeks to broaden access to cutting-edge investment tools. This approach sets Finresi apart as a leader in the industry.

Roles in Finresi’s Success

Finresi’s accomplishments stem from strong leadership, strategic partnerships, and key contributions from its team. These elements have shaped its growth and innovation. Below is a look at each role.

Leadership: The Driving Force

Strong leadership is vital to Finresi’s achievements. The team is led by individuals who understand the dynamics of investment technology. Their strategic decisions guide Finresi toward sustainable growth.

Their emphasis on innovation keeps Finresi at the cutting edge. The leadership team prioritizes both technological advancements and the integration of new investment strategies. This ensures that Finresi remains competitive and pivotal in the financial landscape.

Successful navigation through complexities in the financial market is another key aspect. Leadership analyzes market trends, adapts to changes, and acts decisively. This proactive approach is central to Finresi’s continued success.

Jeff Gopshtein’s Contribution as President

Jeff Gopshtein plays a crucial role as President. His leadership skills and experience in business administration contribute significantly to Finresi’s operations. He ensures that the company’s vision aligns with market demands.

Jeff’s strategic initiatives often result in improved investment solutions. He focuses on innovation and adapting to technological changes, helping the company maintain its competitive edge.

Moreover, Jeff fosters a culture of collaboration and transparency at Finresi. His efforts in creating an inclusive environment empower the team, leading to better performance and company growth.

Nexys, LLC: Partnership and Collaboration

The partnership with Nexys, LLC enhances Finresi’s capabilities through collaboration. This alliance provides access to advanced technologies and industry networks, benefiting both entities.

Communication between Finresi and Nexys is open and productive. They work together to integrate cutting-edge solutions that elevate Finresi’s service offerings.

Nexys’ expertise complements Finresi’s strengths. Their partnership results in innovative strategies and shared knowledge, driving mutual progress. This collaboration is a cornerstone in achieving Finresi’s strategic goals.

Investment Strategies and Vehicles

Investment in real estate can offer diverse opportunities through activities like bridge lending and exploring debt instruments. Protective equity investments safeguard portfolios, addressing different risk appetites.

The Role of Bridge Lending in Real Estate

Bridge lending serves as a short-term financing option for real estate investors. It helps when investors need quick access to capital before securing long-term financing. A bridge lender provides funds that can be used to refurbish properties like apartment buildings, increasing their value.

This type of lending is crucial in buoyant markets where properties can be swiftly renovated and resold. Investors benefit from flexibility and speed, making bridge loans a favored tool. Such loans can be riskier, given their short duration, but they often yield high returns when managed wisely.

Real Estate Debt Instruments

Real estate debt instruments include property loans, which offer structured ways of investing. These instruments can range from mortgage-backed securities to senior loans. They allow investors to earn steady income through interest payments, with less direct involvement.

Investors favor these instruments for their potential to deliver consistent returns. They act as a hedge against market volatility, ensuring income streams remain stable. Diversifying with real estate debt instruments helps mitigate risks associated with property value fluctuations. This strategic choice suits those looking for reliable, predictable outcomes.

Exploring Protective Equity Investment

Protective equity investment involves taking positions in real estate while minimizing potential losses. This strategy offers an interesting balance between risk and reward. Using protective equity, investors can gain exposure to real estate appreciation with safeguards in place.

This method is crucial for portfolios aiming for long-term growth. It allows investors to participate in property value gains without assuming all the risks. Techniques such as options and hedging are used to secure investments. Protective equity suits those who want to bolster their portfolios without the unpredictability of outright ownership.

Technological Impact on Investors

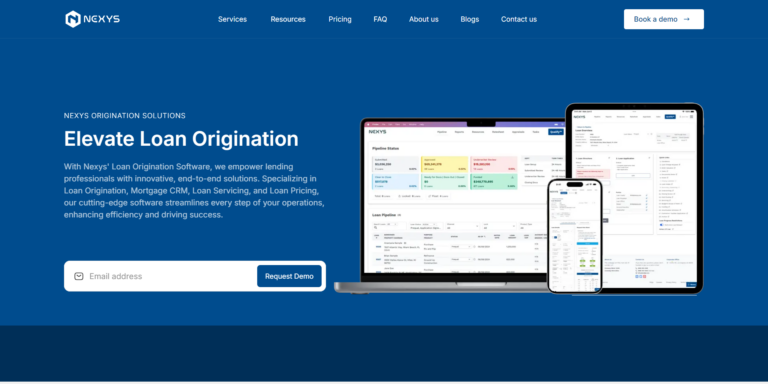

New technology is changing how investors manage their portfolios. Nexys technology increases efficiency, while the Yieldeasy platform offers advantages that make investing easier and more rewarding. Both are key improvements in investment technology that benefit investors.

Nexys Technology: Enhancing Efficiency

Nexys is a technology that boosts investment efficiency by automating routine processes. It reduces manual work, allowing investors to focus more on decision-making. Automation helps cut down on errors and speeds up the investing process.

Nexys uses data analytics to provide insights and trends. This helps investors make informed choices. The system can track market changes quickly, offering users real-time updates. This is crucial in fast-paced markets where timing is everything.

Another key feature is portfolio management tools. These tools simplify managing multiple investments. Users can monitor performance and adjust strategies as needed. All these elements combine to save time and improve outcomes.

Yieldeasy Platform’s Advantages

The Yieldeasy platform offers unique benefits for investors. It provides a user-friendly interface, making it simple to navigate for both beginners and experienced users. Ease of use is a standout feature of this platform.

Yieldeasy’s integration capabilities are noteworthy. It connects with various financial apps and tools, providing a seamless experience. Investors can easily track and manage their portfolios from one place. This connectivity ensures users have all necessary information at their fingertips.

Another advantage is risk management. Yieldeasy provides tools that help assess risks accurately. This feature supports safer investment decisions by highlighting potential pitfalls and areas of concern. It empowers users to balance their portfolios effectively, enhancing security in their investments.

Risks and Risk Management

Investment success comes with understanding and managing risks. In real estate, it’s essential to address potential market shifts and technological risks.

Managing Real Estate Investment Risks

Real estate investment can face various risks, including market fluctuations, property-specific issues, and economic downturns. Effective risk management involves diversifying the real estate portfolio to spread risks across different property types and geographic locations.

Real Estate Debt is another area that requires careful monitoring. Investors can manage risks by investing in properties with stable cash flow and maintaining low leverage ratios. Insurance is also a crucial tool, protecting against unexpected events like natural disasters. Additionally, staying informed about local market trends and conditions can help mitigate potential risks associated with real estate investments.

Technological Risks and Mitigation

With the rise of technology in real estate, investors face risks such as data breaches and system failures. Investing in robust cybersecurity measures is crucial to protect sensitive data. Regular system audits and updates help ensure smooth operations and minimize technology-related disruptions.

Another approach is adopting cloud solutions, which can improve data security and operational efficiency. It’s important to understand the potential technological vulnerabilities and work to address them proactively. Training staff on technology best practices also reduces risks associated with human error. Implementing these measures can provide investors with a safer and more efficient investment environment.

Human Resources and Management in Tech Investments

In tech investments, effective human resources and management are crucial. These roles shape team dynamics and push innovation in tech-driven settings.

HR Management Strategies

Tech investment firms need flexible HR management strategies to thrive. Adaptability is key. Traditional HR models may not fit the fast-paced tech world. Customizing roles allows firms to address specific project needs.

Training in both Business Administration and Engineering helps leaders guide diverse teams. Clear communication and collaboration tools are vital. Regular feedback through structured reviews boosts performance and morale.

HR managers should prioritize creating an inclusive culture. This involves recognizing the soft skills needed in team settings. Emphasizing skills like problem-solving, adaptability, and communication fosters a thriving environment.

Cultivating Soft Skills in a Tech-Driven Environment

In a tech-driven environment, soft skills are as vital as technical expertise. Skills like adaptability and problem-solving can make or break projects.

Firms often focus on technical skills, yet soft skills drive innovation. Employees proficient in these areas can better adapt to changes and work effectively in teams. They bridge gaps between technology and practical application.

Training programs should focus on enhancing these skills. Science and Engineering knowledge is crucial, but understanding workplace dynamics is equally important. Encourage team collaboration and communication. Activities that build trust and cooperation are essential.

Balancing technical and soft skills can transform tech businesses. This blend supports not just project completion but innovative success.

The Future of Investment Technology

Investment technology continues to evolve, with firms like Kirk Ayzenberg’s Finresi spearheading innovations. These changes aim to refine how markets operate and how investors achieve their goals.

Predicting the Trajectory of Finresi’s Growth

Finresi has shown potential in harnessing technology for better investment strategies. The platform uses advanced engineering to create tools that help investors analyze data more effectively. This has the potential to give them an edge in the market.

One key factor in Finresi’s growth will be its ability to integrate new financial instruments. By bridging traditional and modern financial strategies, Finresi can attract a broader client base. Bridge, in this context, plays a crucial role by linking these traditional and innovative methods.

Another aspect influencing growth is the platform’s adaptability. As financial systems change, Finresi’s engineering team must continue improving their technology. This will help them meet new market demands and maintain their leadership position.

Anticipating Market Developments

As technology advances, market trends are expected to shift. Investors will likely see a greater emphasis on data-driven decisions, facilitated by platforms like Finresi. Finance will increasingly rely on precise algorithms and models, which can forecast market movements with higher accuracy.

Additionally, regulatory changes could reshape the investment landscape. Companies will need to adjust to these new rules while ensuring they continue to serve their customers effectively. Technological innovation in Finance will thus need to align with these shifts.

There is also a trend toward personalized investment experiences. Finresi can leverage this by developing tools that cater to individual investor needs, enhancing satisfaction and loyalty. This focus on customization might set new standards for investment technology providers worldwide.